Taxpayers can use a Reverse Exchange to avoid the biggest issue they may face in a §1031 Exchange; namely finding suitable Replacement Property in the short 45-day Identification Period after Closing on the sale of the Relinquished Property. By allowing a Taxpayer to close on the acquisition of the Replacement Property before closing on the sale of the Relinquished Property, a Reverse Exchange provides welcome flexibility.

The authority for Reverse Exchanges is found in Revenue Procedure 2000-37, which was later amended by Revenue Procedure 2004-51. The approved structure involves a “Qualified Exchange Accommodation Arrangement” whereby an “Exchange Accommodation Titleholder” (“EAT”) acquires legal title to either the Replacement Property or the Relinquished Property until the Relinquished Property can be sold to a third party. The EAT is usually a limited liability company that is owned by the Qualified Intermediary company hired by the Taxpayer to facilitate the tax-deferred Exchange. This structure eliminates the dilemma the investor faces. By “parking” title to one of the properties with the EAT, the Taxpayer avoids owning both properties at the same time, which would preclude a “§1031 Exchange”.

While it’s generally easier to park the Replacement Property with the EAT, in certain circumstances that may not be possible. For instance, the lender for the Replacement Property may not approve of the EAT being the owner and the borrower, especially at the last minute when the loan has been underwritten and is ready to Close. In those instances, parking the Relinquished Property with the EAT may be the only option.

Structure

While there are often variations in the structure, the basics of parking the Relinquished Property (also known as an “Exchange First Reverse Exchange”) are as follows:

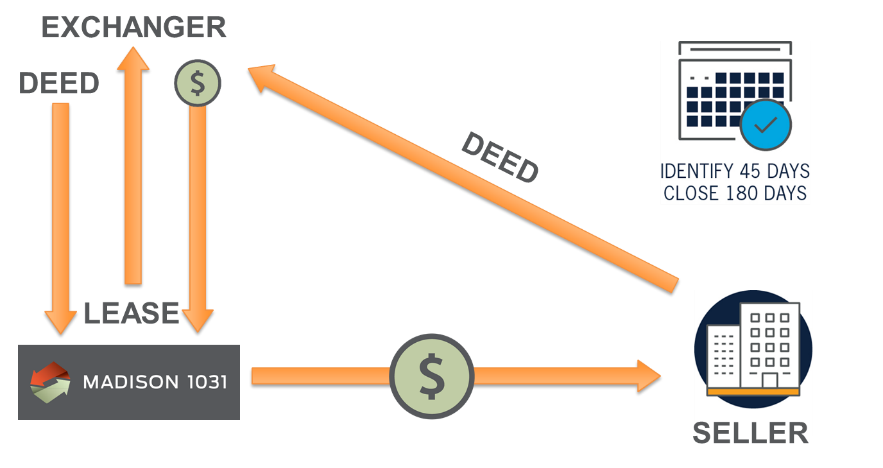

- The Taxpayer finds the ideal Replacement Property to buy. The Seller insists on closing quickly, yet the Relinquished Property has not yet been sold. The parties enter in a Contract of Sale.

- At least one to two weeks prior to Closing on the Replacement Property, the Taxpayer or Taxpayer’s attorney contacts a Qualified Intermediary, who sets up the EAT. The parties enter into a Qualified Exchange Accommodation Arrangement Agreement (“QEAA”), pursuant to which the parties agree that the EAT will purchase the Relinquished Property from the Taxpayer. If an actual buyer for the Relinquished Property has not yet been found, then the purchase price is estimated and is paid through a combination of the assumption of the existing mortgage on the Relinquished Property and carryback financing provided by the Taxpayer to the EAT for the balance documented by a Promissory Note.

- The Taxpayer enters into an Exchange Agreement with the Qualified Intermediary and assigns the benefits of the QEAA to the Qualified Intermediary. At the same time, the Taxpayer also assigns the benefits of the Replacement Property contract to the Qualified Intermediary.

- At Closing, the Taxpayer conveys title of the Relinquished Property to the EAT, and the Taxpayer pays the balance of the purchase price to Qualified Intermediary in return for the EAT’s Promissory Note.

- The Qualified Intermediary in turn pays the Seller of the Replacement Property the funds it received from the Taxpayer. Additionally, the Lender pays the mortgage proceeds to the Seller who then conveys title of the Replacement Property directly to the Taxpayer.

- At this point, the “Exchange” is complete—the Relinquished Property has been sold to the EAT, and the Taxpayer has received the Replacement Property. The EAT may also lease the Relinquished Property to the Exchanger so that the Exchanger has use and occupancy during the Exchange Period and bears the burden for all maintenance, repairs, utilities, and other property-related costs.

STEP 1

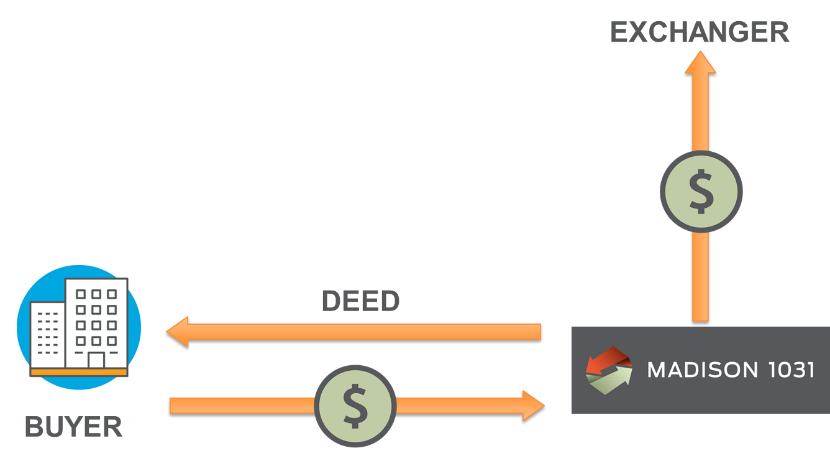

- However, the Relinquished Property still needs to be sold by the EAT to a third-party within the 180-day Exchange Period. Once a buyer is found, the EAT enters into a Contract of Sale to sell the Relinquished Property.

- At Closing, the EAT conveys the Relinquished Property to the Buyer and the sales proceeds are used to pay off both the outstanding mortgage which was assumed by the EAT, and the EAT’s Promissory Note to the Taxpayer.

STEP 2

Considerations:

As previously mentioned, parking the Relinquished Property is generally more complicated than parking the Replacement Property because the transaction is not completed until the Relinquished Property is actually sold to a third-party. As a result, the actual purchase price of the Relinquished Property may be higher than the price estimated at the start of the §1031 Exchange. Additionally, the Taxpayer may not have sufficient funds available to match their equity in the Relinquished Property, requiring them to borrow a higher amount when they acquire the Replacement Property. In either event, the difference in equity could result in the Taxpayer receiving “boot” when the Relinquished Property is sold, which would be subject to taxation. Accordingly, parking the Relinquished Property works best when the Replacement Property acquisition is all cash or is achieved with low leverage. Regardless of which property is parked, depending upon the jurisdiction where the properties are located, duplicate Transfer Tax and Closing fees may need to be addressed.

Given the complexity of Reverse Exchange transactions, advanced planning and timing are essential. Taxpayers should consult with the tax advisors and a knowledgeable Qualified Intermediary as early in the process as possible.