A common question asked by our clients is whether they can do §1031 Exchange when they sell their primary residence. The off-the-cuff answer is “no”. Internal Revenue Code §1031 only applies to properties that are “held for productive use in a trade or business or for investment.” While a residence may be a very good “investment”, the primary usage of the property is typically for the use and enjoyment of the owner of the property and their family rather than to make money when the property is sold. Accordingly, a primary residence typically would not be eligible for a §1031 Exchange.

In these situations, we direct our clients to Internal Revenue Code §121. This allows homeowners to exclude up to $250,000 of gain as a single person or $500,000 of gain as a married couple filing a joint tax return — provided the property was owned and occupied as the taxpayer’s primary residence for two out of the five years prior to the sale.

Without a doubt, this exclusion has been a huge benefit for homeowners! When the law passed in 1997, only the sellers of the very highest-priced properties faced taxes on the sale. Unfortunately, the exclusion amounts were not indexed for inflation, and as real property values have increased dramatically, many homeowners today will find that the gains from selling their homes exceed these thresholds, and that the excess is subject to taxation.

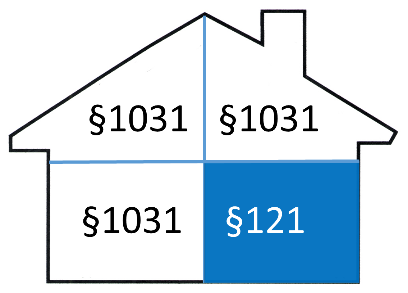

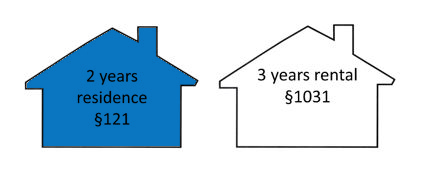

However, there are several scenarios where a homeowner can have their cake and eat it too. (After all, who wants cake if you can’t eat it?). In 2005, the IRS issued Revenue Procedure 2005-14 which allows taxpayers to benefit from both IRC §121 and IRC §1031 if the circumstance warrant. Often referred to as “split treatment” transactions, Rev. Proc. 2005-14 applies when:

- The property usage is physically split — A portion of the property is used as a primary residence, and a portion of the property is used for productive use in a trade, business or for investment. In this situation, when the property is sold, the homeowner is entitled to the IRC §121 gain exclusion on the portion of the property that is used as the primary residence. The homeowner can also defer the gain on the portion of the property that is held for productive use in a trade or business or for investment by exchanging for a like-kind Replacement Property under IRC §1031. This would apply to a Multi-family property in which the homeowner resides in one of several units in the building, an Airbnb property where a portion of the residence is used exclusively for short-term rentals, or a farm where a portion of the property is the owner’s residence and the remaining acreage is used for commercial agriculture purposes.

- The property usage is split by time — A property is used as a primary residence for at least two years and then is converted to a rental or other business use for up to three years. A homeowner whose property has appreciated well beyond the gain exclusions offered by IRC §121 can move out of the property and rent it for a period of time — many advisors suggest two years minimum, but no longer than 3 years — before they sell the property. Since the property was their primary residence for two of the five years prior to sale, they are entitled to the IRC §121 exclusion. Since the property was used for productive use in a trade or business or for investment in the years immediately preceding the sale, they many defer taxes on the remainder of the gain by including the balance of the sales price in a §1031 Exchange and acquiring a like-kind Replacement Property.

Considerations:

The split treatment benefits of Rev. Proc. 2005-14 are not available for vacation homes and second homes not used as the homeowner’s primary residence. However a §1031 Exchange still may be possible for those properties — see our article on Vacation Home Exchanges which discusses Rev. Proc. 2008-16.

Additionally, homeowners should discuss whether and how IRC §121 applies to their property, as well as how the sales price of physically split property should be allocated between the residential and the investment usage of the property.